- Current Account

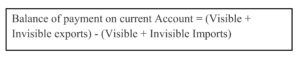

Balance of payments on current account includes the value of imports and exports of both visible(goods) and invisible items(services). Current account transactions are called account of actual transactions,because all items included in it are actually transacted.These items have a direct effect on the income,output and employment of a country’s economy.

Balance of payments on current account may be both balanced and unbalanced.In case of balanced position of BOP,receipts and payment on account of exports and imports are equal. In case of unbalanced balance of payments,it can be in deficit or in surplus.Disequilibrium of the balance of payments on current account is usually balanced with the help of transactions in capital accounts.

- Capital Account

Capital account refers to financial transactions.It mainly includes foreign investment and external loans.All kinds of short term and long term international capital transfers,movement of gold,foreign debts,foreign investments,payments and receipts on account of interest and grants,etc. are also included in capital account.All transactions under capital account are concerned merely with financial transfers,between our country and other foreign countries.

- Overall Balance of Payments

Total of a country’s balance of payments on current account and capital account is known as overall balance of payments.

Disequilibrium in Balance of Payments

Because of several reasons,especially due to differences in the value of exports and imports,disequilibrium in balance of payments may be caused.Disequilibrium may sometimes be on minus/deficit/unfavourable side and sometimes on plus/surplus/favourable side. Unfavourable or favourable balance of payments can be explained as under:

Unfavourable or favourable balance of payments

Balance of payments is said to be unfavourable when the payments (debit) of the country are more than its receipts (credit). On the other hand, when the payments (debit) of the country are less than its receipts (credit), the balance of payments is said to be favourable. Disequilibrium in balance of payments may be of two kinds:

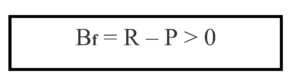

- Favourable balance of Payments

When receipts are more than payments then balance of payments turns favourable.This situation increases foreign exchange reserves.In this case exports of goods ,services and capital receipts are more than import of goods, services and capital payments.It is also known as surplus balance of payments.

(Here Bf =Balanced balance of Payment;R-P>0=Receipts are greater than payments or their difference is positive.)

2. Unfavorable Balance of Payments

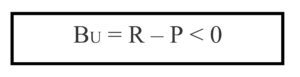

Balance of payments is unfavorable when its payments are more than its receipts. This situation reduces foreign exchange reserves. In this case exports of goods, services and capital receipts are less than import of goods, services and capital receipts are less than import of goods, services and capital payments. It is also known as deficient balance of payments.

(Here, BF= Favourable balance of payments; R-P <0=Receipts, are less than payments or their difference is negative.)

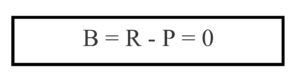

- Equilibrium in Balance of Payments

When capital receipts of a country and exports(visible and invisible) are to its capital payments and imports(visible and invisible) then its balance of payments is in equilibrium.

(Here, B = balanced balance of payments; R =Reciepts,P=Payments)

In short,balance of payments is unfavourable,if to meet the deficit between receipts and payments a country either makes payments in terms of gold or borrows from abroad for a short period.On the contrary,if to meet the surplus between receipts and payments a country either receives payment in terms of gold or lends to foreign countries for a short period,the balance of payments is said to be favourable.