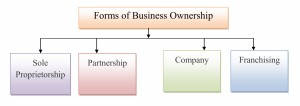

Forms of Business Ownership

The perspective entrepreneurs need to identify the legal structure that will best suit the demands of the venture before deciding how to organize an operation for business. For establishing a business the most important task is to select a proper form of organization as the conduct of business, its control, acquisition of capital, extent of risk, distribution of profit, legal formalities, etc. all depend on the form of organization. The necessity for choosing a suitable form derives from changing tax laws, the availability of capital or fund, liability situations, and the complexity involved in formation of business. The most important forms of business organization are as follows:

- Sole Proprietorship

- Partnership

- Company

- Franchising

1. Sole Proprietorship

A sole proprietorship is owned by only one person. This is the most common form of business ownership. It can include small retail stores, mechanic services and even inventors or musicians seeking to sell their products online. It is fairly easy to establish a sole proprietorship, and the process of running them is fairly simple.

Advantages of Sole Proprietorships

i. Ease of starting and ending the business

ii. Being your own boss.

iii. Pride of ownership as sole proprietors have taken the risk and deserve the credit.

iv. Leaving a legacy behind for future generations.

v. Retention of company profit

vi. No special taxes

Disadvantages of Sole Proprietorships.

i. Unlimited liability is the responsibility of business owners for all of the debts of the business.

ii. Limited financial resources. funds available are limited to the funds that the sole owner can gather.

iii. Management difficulties. many owners are not skilled at record keeping.

iv. Overwhelming time commitment. the owner has no one with whom to share the burden.

v. Few fringe benefits. fringe benefits can add up to 30% of a worker’s income.

vi. Limited growth

vii. Limited life span. if the sole proprietor dies or leaves, the business ends.

2. Partnership

A partnership is similar to sole proprietorship, except more than one person is involved. Two or more people come together to work at a given business and share in the profits (or losses) or that business. Like sole proprietorship, a partnership is relatively easy to set up and doesn’t have to pay the sort of taxes that larger corporations do. However, the partners themselves are responsible for business losses and liabilities, and partnerships founded on informal agreements may run into interpersonal problems when the company struggles.

Advantages of Partnerships

i. More financial resources. two or more people pool their money and credit.

ii. Shared management and pooled/ complementary knowledge. partners provide different skills and perspectives.

iii. Longer survival. partners are four times as likely to succeed as sole proprietorships.

iv. No special taxes.all profits of partners are taxed as personal income of the owners.

Disadvantages of Partnerships

i. Unlimited liability.

ii. Each general partner is liable for the debts of the firm, no matter who was responsible for causing those debts.

iii. You are liable for your partners’ mistakes as well as your own.

iv. Division of profits. sharing profits can cause conflicts.

v. Disagreements among partners.

vi. Disagreements can arise over division of authority, purchasing decisions, and so on.

vii. Because of such potential conflicts, all terms of partnership should be spelled out in writing to protect all parties.

viii. Difficult to terminate. for example: Who gets what and what happens next?