Principle of Maximum Social Advantage

The ‘Principle of Maximum Social Advantage’ was introduced by British economist Hugh Dalton. Public Finance” is concerned with income & expenditure of public authorities and with the adjustment of one with the other.

Budgetary activities of the government results in transfer of purchasing power from some individuals to others. Taxation causes transfer of purchasing power from tax payers to the public authorities, while public expenditure results in transfers back from the public authorities to some individuals, therefore financial operations of the government cause ‘Sacrifice or Disutility’ on one hand and ‘Benefits or Utility’ on the other.

This results in changes in pattern of production, consumption & distribution of income and wealth. So it is important to know whether those changes are socially advantageous or not.

If they are socially advantageous, then the financial operations are justified otherwise not. According to Dalton, the principle of maximum social advantage is the most fundamental principle lying at the root of public finance. Hence, the best system of public finance is that which secures the maximum social advantage from its fiscal operations.

Assumptions

The principle of social maximum advantage is based on the following assumptions.

- Taxes are the major source of government revenue.

- The law of diminishing marginal social advantage applies to the public expenditure.

- The taxes are subject to increasing marginal social Disutility.

Conditions of Maximum Social Advantage

The main conditions of maximum Social Advantage are as follows:

- The social benefit from the rupee spent(MSB) on public expenditure should be equal to the sacrifice(MSS) from the last rupee collected by way of a tax.It implies that MSB=MSS.

- Public expenditure should be so distributed among various schemes that benefit of last rupee spent on every scheme should be equal.

- Taxations should be levied in different directions such that scarify or disutility from last rupee collected from every direction should be equal.

Explanation

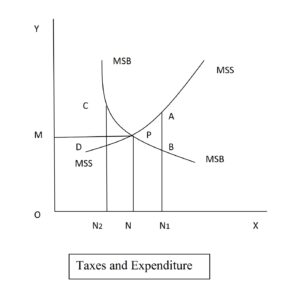

Government collects revenue in the form of taxes and o transfers that revenue to the public in the form of public expenditure.The sacrifice that society has to make by paying taxes,is called social sacrifice.Similarly,the gains which society makes by government expenditure on healthcare ,education etc. is called social satisfaction or Benefit.The government should strike a balance between the public revenue and public expenditure in such a way as could yield maximum satisfaction.This depends upon the Diminishing Marginal Utility and Equi-Marginal Utility.The maximum satisfaction is achieved when Marginal Social Sacrifice(MSS) due to taxation become equal to Marginal Social Benefit(MSB) due to expenditure.Thus Maximum Social advantage is obtained when,

MSS=MSB

MSS-Marginal Social Sacrifice

MSB-Marginal Social Benefit

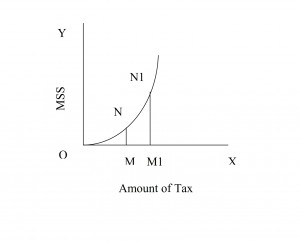

i. Marginal Social Sacrifice

When a tax is levied,people have to part with their money to give a segment of their money in the form of taxes.This causes monetary sacrifice.This results in reduction of purchasing power of people.The MSS curve indicates the rising marginal social sacrifice with every increase in the taxes.

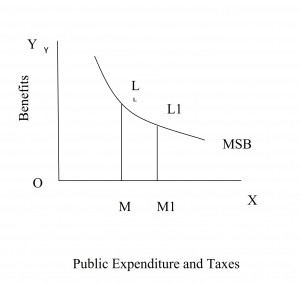

ii. Diminishing Marginal Social Benefits (MSB)

When the government undertakes public expenditure,the society gets utility or benefits.But as more and more benefits are provided to the people,its utility to them goes on diminishing.The MSB curve shows diminishing marginal social benefit.When the public expenditure increases from OM to OM1 the marginal social benefit decline from LM to L1M1.

iii. Maximum Social Advantage

Since,the marginal social benefit goes on diminishing and marginal social benefit goes on diminishing and marginal social sacrifice goes on increasing with every additional change in expenditure and taxes respectively,the government goes on comparing marginal social sacrifice with marginal social benefit while it imposes taxes or make public expenditure.The conditions of maximum social advantages have been stated differently by different economists.