Price elasticity

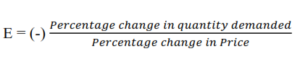

The price elasticity of demand is the measure of the responsiveness of quantity demanded of a good to changes in good’s price, other things being equal. Price elasticity of demand is the ratio of the percentage change in the quantity demanded of a commodity to a percentage change in its price. Price elasticity of demand denotes the ratio at which the demand contracts with a rise in price and extends with a fall in price. There is an inverse relationship between price and quantity demanded of a good. Accordingly, elasticity of demand is expressed by minus (-) sign .

In the words of Lipsey,

“Because of the negative slope of the demand curve, the price and the quantity will always change in opposite directions. One change will be positive and the other negative, making the measured elasticity of demand negative.”

However the custom is to ignore the negative sign and discuss only the absolute level of the price elasticity. In other words price elasticity of demand is expressed as a number eliminating the need to deal with the negative sign.

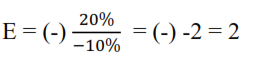

Supposing fall in price by 10% is followed by extension in demand by 20 %. Fall in price is indicated by minus (-) sign. On multiplication these minus sign, turn to plus (+) sign

Definition

Price elasticity of demand measures the responsiveness of the quantity demanded of a good to the change in its price.

-Boulding

Factors determining Price elasticity of demand

- Availability of Substitutes

The higher the degree of closeness of the substitutes, the greater the elasticity of demand for the commodity . Coffee and tea, sandals and chappals, milk shake and lassi etc. may be considered as close substitutes for one another. If price of one of these goods increases, the other commodity becomes relatively cheaper. For example coffee becomes cheaper than tea , the demand for coffee will increase and that of tea will decrease. Therefore consumers buy more of relatively cheaper goods than costlier one, al other things remaining the same. So the elasticity of demand for both these goods will be higher. Wider the range of substitutes, the greater the elasticity. For instance, soaps , toothpastes, cigarettes etc. are available in different brands each being substitute for the other. Therefore, the price elasticity of demand for each brand is much greater than that for generic commodity.

- Nature of commodity

Commodities can be grouped as luxuries, comforts and necessities. The demand for luxury goods like high price refrigerators, T.V sets, cars etc., is more elastic than the demand for necessities and comforts because consumption of luxury goods can be dispensed or postponed when their prices rise. In case of necessary goods like oil, match boxes , salt, sugar etc. a consumer has to buy a given quantity of these goods, irrespective of the rise or fall in the price. Hence their demand is inelastic. Comforts have more elastic demand than necessities and less elastic than luxuries. Commodities are also categorized as durables and non-durables (perishable goods) . Demand for durable goods is more elastic than that for non-durable goods, because when the price of durables increases people either get the old one repaired instead of replacing it or buy a second hand.

- Goods with different uses

Goods that can be put to different uses have elastic demand. For example electricity has many uses. It can be used for heating, lighting, cooling etc. When electricity charges are high, it is used for lighting purpose only and so its demand for other less urgent uses will fall considerably.The wider the range of uses of a product, the higher the elasticity of demand for the decrease in price. As the price of a multi-use commodity decreases, people extend their consumption to tits other uses.

- Income of the consumer

People having very high or very low income, ordinarily, have inelastic demand. It is so because rise or fall in the price has very little effect on their demand. On the other hand, demand of middle- income people is elastic. Rise in the price of goods demanded by these people leads to contraction in their demand.

- Time

Demand for a good is inelastic in short- period and elastic in long period. It is so because a consumer can change his habits in the long run. Fall in the period of a good therefore leads to more extension in its demand in the long run.

- Recurrence of demand

If the demand for a commodity is of a recurring nature, its price elasticity is higher than that of a commodity which is purchased once. For example bicycles, tape recorders etc. are purchased only once, hence their price elasticity will be less. But the demand for batteries, tapes would be more price elastic.

- Price level

Very high prices and very low priced goods have inelastic demand. Very high priced goods have inelastic demand e.g diamond, jwellery etc. change in the price of these goods cause little change in their demand. Likewise very low priced goods have also inelastic demand, e.g. vegetables, match box etc. Change in the price of these goods cause little change in their demand. On the contrary, medium priced goods i.e. neither very expensive nor very cheap, have elastic demand. Fall in their price stimulates relatively more demand.

- Habit of consumer

Demand for those goods is inelastic to which consumers become habituated e.g. cigarette, tea, coffee etc. Despite rise in their prices people demand such goods in more or less the same quantity.

- Joint Demand

Goods demanded jointly have inelastic demand. For example car and petrol, pen and ink, camera and film. Rise in the price of petrol may not contract its demand if there is no fall in the demand for cars.

- Postponement of the use

Goods whose demand can be postponed to a future period have elastic demand. For example, if demand for building houses can be postponed then demand for building material such as bricks, cement, lime etc. will become elastic. On the other hand goods whose demand cannot be postponed, e.g. demand for meals when hungry or for drink when feeling thirsty, have inelastic demand.