Cross elasticity of demand

Meaning

The Cross elasticity of Demand is the measure of responsiveness of demand for a commodity to the changes in the price of its substitutes and complementary goods. For example, change in the price of tea ordinarily causes change in demand for coffee. Likewise, change in the price of cars causes change in demand for petrol.

Formula of Calculation

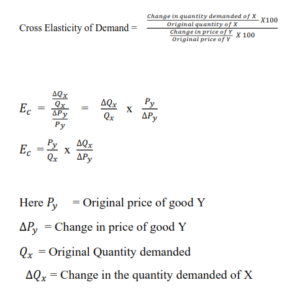

The formula for calculating cross elasticity of demand is as follows:

Definitions

The cross elasticity of demand is the proportional change in the quantity demanded of good X divided by the proportional change in the price of the related good Y

-Ferguson

The cross elasticity of demand is a measure of the responsiveness of purchases of X tochange in the price of Y

-Leibhafsky

Degree of Cross Elasticity of Demand

When two goods are substitute for one another their demand has positive cross elasticity because increase in the price of one increases the demand for the other. And, the demand for complementary goods has negative cross elasticity, because increase in the price of a good decreases the demand for its complementary goods.

-

Positive

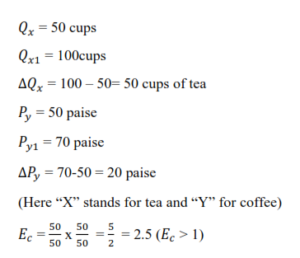

When goods are substitutes of each other, then a given percentage rise in the price of good will lead to a given percentage increase in the demand for the other good. In other words , cross elasticity of demand is positive in case of subtitles. For example, rise in the price of coffee will lead to increase in demand for tea, because the two are close substitutes of each other. It can be explained with an example. Supposing, when price of coffee 50 paise per cup, then demand for tea is 50 cups. If price of coffee rises to 70 paise per cup, then demand for tea goes upto 100 cups. Thus, cross elasticity of demand for tea can be calculated by the above formula.

Thus, cross elasticity for tea is greater than unity.

Cross elasticity of demand in case of substitutes e.g. tea and coffee is illustrated in fig. 1. In this diagram quantity of tea is shown on OX-axis and price of coffee on OY- axis. When price of coffee is , demand for tea increases to . DCDC curve represents different quantities of tea demanded as a result of change in price of coffee. This curve slopes upward from left to right. It means rise in price of coffee will lead to increase in demand for tea and fall in the price of coffee will lead to decrease in demand for tea.

2. Negative

In case of complementary goods , percentage rise in the price of one leads to percentage fall in the demand of the other. Consequently, cross elasticity of demand is negative and the same is indicated by putting a minus ( -) sign before the number of cross elasticity of demand. It is explained with the help of an example. Supposing, bread and butter are complementary goods. When price of bread is 80 paise per piece, then demand for butter is 10 kg. With the rise of price of bread to Rs. 1. 20, demand for bread falls to 5 kg. In this situation, cross elasticity of demand for butter is calculated as under.

(Here, x stands for butter, and y for bread)

Negative Cross elasticity of demand is explained with the help of following figure. Quantity of butter is shown on OX- axis and price of bread on OY- axis. DCDC curve represents negative cross elasticity of demand. It slopes downwards from left to right, signifying that rise in price of bread will bring down the demand for butter. Points E and indicate that at OP price of bread, demand for butter is OQ. When price of bread rises to then demand for butter is contracted to

iii. Zero cross elasticity of demand

Cross elasticity of demand is zero when two goods are not related to each other. For example rise in the price of wheat will have no effect on the demand for shoes. Their cross elasticity of demand will be called zero.